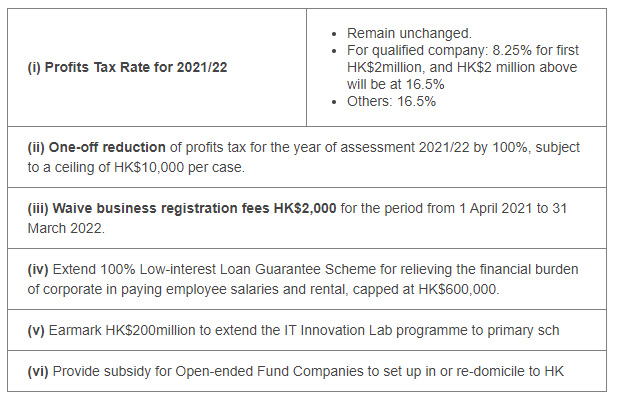

In February 2021, the Financial Secretary has announced 2021/22 Budget, outlining the plans for the economy and proposals for changes to taxation. The major proposed tax concessions and measures including:

For Corporate

For Salaries/ Individuals Tax

(i) One-off reduction of salaries tax for the year of assessment 2021/22 by 100%, subject to a ceiling of HK$10,000 per case

(ii) No change in the standard tax rate, progressive tax rates and tax bands

(iii) No change in all kinds of individual allowance

Others

(i) Actively implement OECD’s BEPS 2.0 proposals

(ii) Increasing the rate of stamp duty on stock transfers from 0.1% to 0.13% (total: 0.26%)

(iii) Will consider new taxes to address the problem of HK’s narrow tax base