For centuries, Double Taxation Agreement has been developed to eliminate double taxation on an individual or corporation in supporting the growth of the global economy. This development has ended up facilitating double non-taxation and led to a critical situation with increasing people avoiding tax in worldwide. “Times magazine” revealed that Google has shifted billions of revenues arising in the U.S. to shell companies established in five countries including Ireland and the Netherlands, in order to escape 35% U.S. tax obligation.

On July 2013, the Organization for Economic Co-operation and Development (OECD) released its Base Erosion & Profit Shifting (BEPS) Action Plan with the aim to tackle double non-taxation corporation, cross-border tax avoidance and evasion cases. The action plan places great effort in enhancing the coordination and collaboration among tax authority of different countries to combat the phenomenon of tax escape through the unjustifiable use of tax havens and to draw up transparent standards for tax authority to have an automatic tax information exchange among countries to prevent BEPS issues.

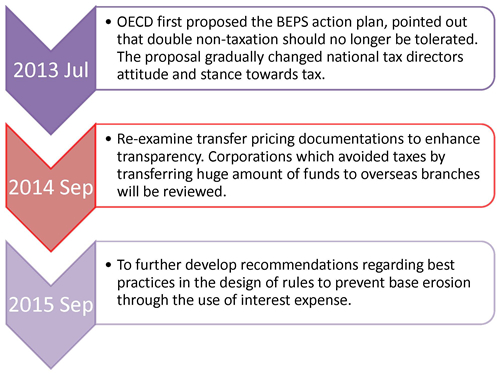

Below are the key dates and deliverables:

Needless to say, preventing tax treaty abuse has become increasingly important where numerous international government bodies are collaboratively working on new global standards to close the loopholes, even multinational companies such as Google cannot be escaped.

With the implementation of BEPS actions on the road, multinational companies should monitor these developments in order to effectively plan for their operation structure and adopt the most advantageous tax strategy so as to minimize the potential impact derive from these international tax reform.

In other words, to tackle these issues brought by the BEPS actions plan, companies need to understand the comparative advantage of each market location that could bring to their business and then further design a business structure that could fully utilize the unique benefit generates in the market. For instance, company establishing an operation in a developing country can enjoy the a production cost and focus the investment on their core management and support function in developed place, such as Hong Kong, which can provide various professional services with international standard. This all because Hong Kong is a place which enjoys sustainable financial system, with low corporate tax rate and reliable economical fundamentals, which can create a reliable environment to handle management and support services.

In short run, company can reasonably reduce the overall corporate tax liabilities by simply placing the core management function in Hong Kong. As a reference, the tax rate in Hong Kong is only 16.5%, significantly lower than 35% in U.S., 28% in U.K. and 27% in China. Most importantly, enterprises can easily find long term support for high quality professional services with international standard, such as financial, accounting, law and risk management in Hong Kong and is irreplaceable by other countries – Hong Kong as an international financial centre is widely recognize which makes Hong Kong to be the best place to invest.

To have a better illustration:

A Korean citizen who runs international business activities can (1) place the production line in a Low-Cost developing countries (e.g. China), whilst (2) establish a base office in a developed countries (e.g. Hong Kong) to utilize the professional resources in the market to support for their core management function. Under such circumstances, despite the Korean citizen is liable for both PRC tax and Hong Kong tax, it will still put the business in a more advantageous position with this arrangement:

- The overall tax payment is still lower than just paying all in China.

- Greatly reduces the opearting cost by having a production base in China instead of Korea.

- Enjoy the benefit of using the professional support services in Hong Kong.

- Tax authorities will not actively issue review documents to him which saves lots of administrative work.