2017-2018 Newsletter – Company Highlight

– Event 1 –

Event Name: Investigating the Free Trade Zone in Nansha

Location: Nansha, China

Date: 17th April 2017

We are delighted to be a participant of the tour to the Free Trade Zone in Nansha, which organized by the Association of Sino Enterprises Promotion (ASEP), for an inspection and discussion.

The overall development of the Nansha Free Trade Zone, various business innovation services, economic and trade preferential policies and measures were well discussed. The representatives of the Nansha Free Trade Zone Administration have exchanged the latest entrepreneur and business environment with us. Operations that have accessed to the district were interviewed. Last but not least, the representatives of The Chinese Institute of Certified Public Accountants and the government had shared their views on recent development during a precious meal time together.

We would like to express our gratitude to ASEP for holding a fruitful trip for us to obtain a deeper understanding on the recent development of the Nansha Free Trade Zone.

– Event 2 –

Event Name: Summit on the New Directions for Taxation

Location: Central Government Offices, Hong Kong

Date: 23th October 2017

Our managing director Ms. CY Chan was invited to attend the Summit on the New Directions for Taxation (“the Summit”) by the Government of the Hong Kong Special Administrative Region.

The Summit is one of the key initiatives of the Current-term Government in seeking views on forward-looking tax policies and measures. Two main topics were discussed: (1) Global Trends for Tax Policy and (2) Tax Initiatives for Enhancing Economic Development. The Financial Secretary, Mr Paul CHAN Mo-po, delivered a keynote speech on the global trends for tax policy; followed by the keynote speech from Director of Center for Tax Policy and Administration, Mr Pascal SAINT-AMANS and Professor Lawrence J. LAU. Discussion sessions were arranged for us to share our views on tax initiatives for fostering economic development. The two Panel Discussions were: (1) Reinforcing Pillar Industries and (2) Towards a Diversified Economy.

If you are interested to have a deeper understanding about the topic, please feel free to contact us.

– Event 3 –

Event Name: Meeting of Guangdong, Hong Kong, Macau and Taiwan Tax Conference

Location: Guangzhou, China

Date: 9th November 2018

Our managing director Ms. CY Chan was invited to attend the 13th Annual General Meeting of Guangdong, Hong Kong, Macau and Taiwan Tax Conference, which organized by The Chinese Tax Institute, to strengthen the academic exchange about tax among these 4 jurisdictions.

The agenda of this Conference was “Research on Tax Coordination and Cooperation in Promoting the Construction of Guangdong-Hong Kong-Macao Greater Bay Area”. Ms. Wong Wai Pan, The President of Board of Directors of our Association, headed five members to participate in this Conference. In correspond to the topic, Ms. Ho Choi San, Técnico Superior Assessor Principal from Macau Financial Services Bureau were invited to discuss the view on current Macau tax system and policy, Bilateral Tax Agreement, Integration Opportunities and Challenges of The Greater Bay Area, and Cross Border Coordination and Cooperation between Tax Authorities.

If you are interested into these topics, please feel free to contact us for further information.

– Event 4 –

Event Name: CTA Conference 2018: Fall Behind or Go Beyond in Achieving BEPS Compliance Excellence and Preparing for Greater Bay Area Opportunities?

Location: Hong Kong Convention and Exhibition Centre, Hong Kong

Date: 23th November 2018

Our managing director Ms. CY Chan was again being invited to attend the Tax Conference organized by The Taxation Institute of Hong Kong(TIHK).

This year, the Conference continues to aim at offering a platform for exchanging the latest tax development and helping participants acquire industry insights to prepare for unexpected challenges in the future. The Conference also serves as a great platform for sharing insights on how to leverage on the numerous opportunities from the Greater Bay Area. Prominent speakers from overseas, Mainland China’s and Hong Kong’s tax authorities, experienced practitioners from leading Professional firms as well as business owners and investors had shared their views on the above theme.

2017-2018 Newsletter – Market Flash

– Tax Evasion Storm Is Coming, Do Not Run Into It –

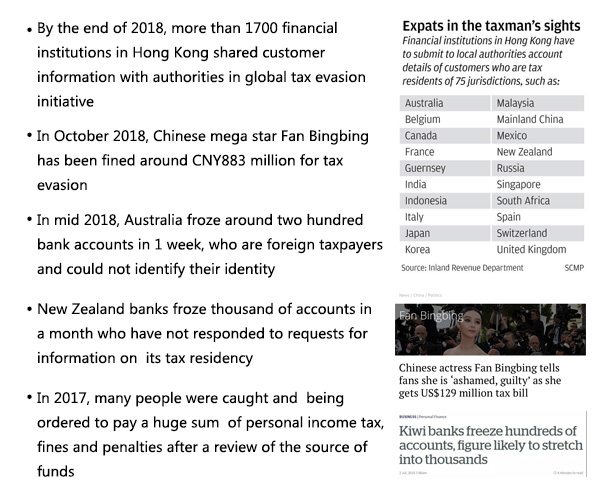

The latest breaking news and news headlines are flooded with the broadcast of how the governments are tackling tax evasion and hunting for hidden overseas assets:

The implementation of the Organisation for Economic Co-operation and Development’s (OECD) Base erosion and profit shifting (BEPS) recommendation, enacted of anti-avoidance provisions, tax transparency and measures, have a significant impact on corporate and individual taxpayers.

The BEPS project: Background

The idea of having automatic exchange information of Multinational Group Companies was first developed in 1988: two jurisdictions to exchange information under the convention with each other. By the end of 2018, there are 126 counties and jurisdictions participated in the convention and completed the first time information exchange in 2018.

In fact, this is one of the action under the project of Base Erosion and Profits Shifting (“BEPS project”), for instance, the common reporting system (“CRS”)and automatic exchange of information (“AEOI”) are the minimum standards in the BESP project.

The goal of the BEPS project is to identify common cross border tax planning techniques and to eliminate them, as well as preventing double non-taxation of profits. The project started since 2013 and has attracted more than 116 countries to commit in taking anti-BEPS steps. It has become more and more intense, which has aroused also the attention of the media and the public.

The BEPS project: Update

This on-going BEPS project has numerous changes in international tax policy over the years, the most recent changes include:

- On 22 Oct 2018, to tackle a misuse of residence and citizenship by investment schemes (“RBI/CBI”) with low or zero tax rate on foreign financial income and the limited physical requirements. OECD issued a guidance for financial institutions to conduct enhanced due diligence on this kind of account holders.

- On 21-22 July 2018, G20 Finance Ministers and Central Bank Governors had hold a meeting in Argentina. In the communique, G20 Finance Ministers emphasized the importance of the global implementation of the BEPS project and committed to work together in finding out a solution to solve the impacts of Base erosion and profit shifting issue of the worldwide tax system by 2020. All jurisdictions were asked to approve and sign the multinational Convention on Mutual Administrative Assistance in Tax Matters. Hong Kong, has begun implementing the OECD’s BEPS program and has enacted new BEPS and transfer pricing regulations that introduce transfer pricing regulatory systems and documentation requirements into Hong Kong tax laws. The regulations enforce certain minimum standards under the OECD’s BEPS Action Plan (Actions 5, 13 and 14).

What are the safety rules when a typhoon is coming or saving for a rainy day?

In fact, one do not even bother to consider the impacts of CRS if one’s assets are all safekeep in the country he/she lives. However, if you are one of the following persons, it is time to be alert and take precautions.

- Party 1: a citizen of Country A who have obtained permanent residency in other countries

Under Common Reporting System (“CRS”), all hidden assets in Country A of Party 1, who has migrated overseas (e.g. Country B) will be disclosed to the jurisdiction they reside. Country B will tax or even fine Party 1 on the hidden assets which located in Country A, according to the laws of Country B. - Party 2: a citizen of Country B who have deployed their financial assets overseas

Country B will have a full information over the financial assets overseas (e.g. Country X) of Party 2 under CRS, the information of overseas assets will be transferred directly from Country X to Country B, if Country X is a member under CRS. - Party 3: a citizen of Country C who is holding an oversea shell company for investment and wealth management

Under the CRS standard, the offshore companies are required to declare the underlying beneficial owners; information of all financial assets owned by Party 3 through holding an offshore company will be exchanged to Country C. Tax avoidance by holding a shell company/ an offshore company will be disclosed. - Party 4: a citizen of Country D who bought a large amount of life insurance in overseas

Financial data, including life insurance will be disclosed under CRS. Insurance purchased by Party 4 and its related information will be exchanged to Country D. - Party 5: a citizen of Country E who set up Trust in overseas (e.g. family trust)

Under the CRS, all related information about the establishment of Trust should be disclosed. Information, including beneficiaries, trustee, settlor, entrusted assets will be exchange to Country E - Party 6: a citizens of Country F who set up company overseas for international trading

Under CRS , all oversea companies, which set up by Party 6 will be disclosed, information of the oversea companies will be exchanged to Country F.

The only solution is to streamline your business and change the way in managing your wealth, make things easier and simpler. If you are interested to learn more about it, please do not hesitate to contact us.

– Is OCED Acting For The Regulators Only? –

On the upside, OECD is attempting to harmonize the tax systems on a global basis and therefore plays an important role in leading tax system of countries to converge over time.

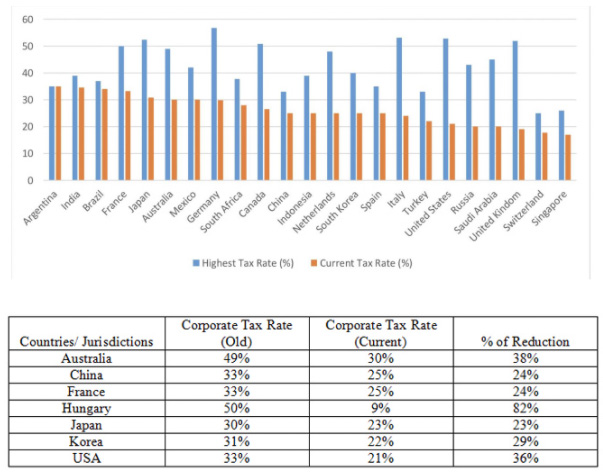

A report showed that there is a continuation of a trend toward corporate and personal income tax rate cuts, by doing so, countries intends to stimulate economic activity and attract foreign investment. Different countries are altering their tax system in order to be competitive enough to promote economic development.

Downward Trend of Corporate Tax Rate By Country

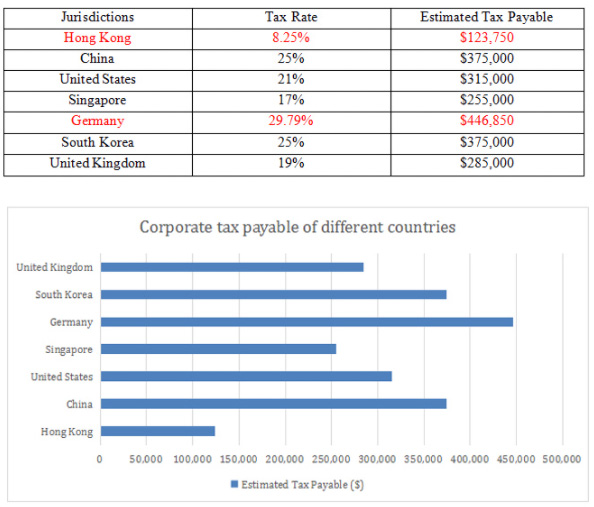

Case illustration

Tax system determines how much tax do company/ business pay, and it varies from country to country. Below example demonstrates the tax distinction between different countries’ tax systems with the same earnings:

Example: Assume a company earns $1,500,000 in a year

From the above results, it clearly demonstrates Hong Kong has the lowest tax rate while Germany has the highest one. Since Hong Kong has a simple and low tax regime, foreign investors and entrepreneurs would generally choose Hong Kong as their preferred jurisdiction for establishing a head quarter and a hub in expanding their global business.

In 2018, major international organisations – including OECD called on governments from around the world to strengthen and increase the effectiveness of their tax systems to generate the domestic resources needed to meet the Sustainable Development Goals (SDGs) and promote inclusive economic growth. “The OECD stands ready to work closely with all of you to achieve modern and efficient taxation systems in which everybody pays their fair share!” remarks by Angel Gurría, Secretary-General of the OECD.

“The BEPS report essentially provides countries with recommendations to update and refine their tax laws as well as propose changes to their double tax treaties to minimise the gaps and mismatches that MNCs have been using to level the playing field,” Daniel Woo explains.

“The challenge for every government around the world is, how do they protect one country’s tax base? How do they have enough money to do the things they want to do? So, running alongside all these international tax changes, it’s interesting to see how governments are bringing in new taxes and [finding] new ways to tax…

In spite of the fact that there is no perfect tax system, a good tax system should always be FAIR, ADEQUATE, SIMPLE, TRANSPARENT and ADMINISTRATIVE EASE.