Newsletter 2015 – Company Highlight

– Event 1 –

CY CPA firm was again invited by HKTDC to participate in the “Smart HK” exhibition held in Jinan International Convention & Exhibition Centre. Our managing director CY made a speech on “One belt One Road: the roles of Hong Kong” during the event and followed by an interview from the reporter of a popular local newspapar – Qilu Evening News (齊魯晚報). We shared our views on how Shangdong enterprises should utilize Hong Kong as a platform which will provide a favorable environment for future business growth.

Event Name: SmartHK

Location: Jinan International Convention & Exhibition Center

Date: 27 – 28 May 2015

The expo has provided us with a valuable opportunity to have a face to face discussion with numerous Shangdong enterprises across various sectors and gave us a key to understand how do these Chinese domestic companies expand their business out of China into the Global markets. We have received enthusiastic responses on the ‘Going out’ discussion, in which many of the companies have already started establishing branches in overseas. We believe one of the key success factors of these Shangdong enterprises is their pragmatic approach in dealing business and able to adjust their pace for market change from time to time.

While the Chinese government is putting more effort in helping these domestic companies to expand globally, we believe this will create more opportunities for their business development.

We are delighted and honored to participate in this event. A special thanks to Mr. Yang (Managing Director of YAGOOL) for his sharing and time.

– Event 2 –

Event Name: Shandong Hong Kong Economy & Trade Cooperation High-Level Round Table Meeting

Location: Hong Kong Convention and Exhibition Centre

Date: 1 September 2015

We were delighted that our managing director, CY Chan, was being invited to the Shandong Hong Kong Economy & Trade Cooperation High-Level Round Table Meeting which held on 1 September 2015. It was a privilege to be able to attend the luncheon meeting with Mr Xia Geng, Vice Governor of Shandong Province, to give our business view on the cooperation between Hong Kong and Shandong.

During the meeting, it has been discussed how the Chinese enterprises could utilize Hong Kong as a capital formation platform and to strengthen the financial collaboration between the two regions. The Made in China 2025 plan was also discussed, this is an initiative to move manufacturing up the value chain and to achieve much greater international brand recognition. It is anticipated that the plan will accelerate the transformation & upgrading of the manufacturing sector and will support the Shandong enterprises in the “going out” process. The conversation was valuable and a rewarding information exchange which gave us insight into future cooperation opportunity with the Chinese enterprises.

– Event 3 –

Event Name: CTA Conference 2015 – Positions of HK and China under the Global Tax Development

Location: Hong Kong Convention and Exhibition Centre

Date: 20th November, 2015

Our Director Ms. CY Chan has attended the CTA conference for the latest global tax development update. Agenda item included the latest Base Erosion and Profit Shifting (BEPS) development, permanent establishment redefinition, transfer pricing latest development, Hong Kong tax development under global tax requirement, and business opportunity under “One Belt One Road”.

During the conference, a brand new concept “Country-by-Country” (CBC) was discussed. European Union (EU) has started to modify the EU rules and the guidelines to align with the BEPS Action Plan recommendations. It is anticipated that the implementation of CBC will be able to strengthen the communication among countries and increase tax transparency of enterprises.

If you are interested into topics regarding BEPS, “One Belt One Road” or CBC concepts, please feel free to contact us for further information.

Market Flash

– One Belt One Road –

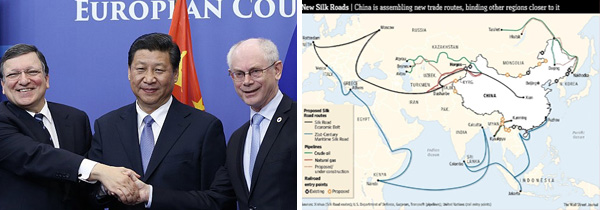

One Belt One Road (also known as New Silk Road) is the latest hot development strategy and framework proposed by the Chinese government. It focuses on cooperation and infrastructure along the land (the “belt” connecting China, Central Asia, Russia and Europe) and sea (the “road” linking China to ASEAN, India, Africa) trade routes. The purpose is to sustain the investment and growth in China as well as to stimulate economic and financial integration internationally.

One Belt One Road – the roles of Hong Kong

It is anticipated that China’s investment on infrastructure along the new land and sea silk roads should boost foreign demand and trade flows. Hong Kong, as a world class financial, commercial and maritime centre, can provide Mainland enterprises that seek to “going out” with a wide range of professional services and achieve a healthy growth on both financial and non-financial aspects, for instances, facilities connectivity, investment & trade co-operation, people-to-people bonds.

The following are reasons why Hong Kong would be the ideal place:

1. Hong Kong, strategically located in Asia

Hong Kong is well-known for its free port as it is strategically located in the heart of Asia and adjacent to Mainland. With its strategic geographical location, Hong Kong has been successfully transformed into a global trade and logistics hub throughout the years, and finally build a competitive advantage across the globe.

2. Facilities connectivity, investment & trade co-operation

The Silk Road Economic Belt Initiative focuses on infrastructure development, especially the regional transportation and connectivity projects along the Belt and Road countries. Hong Kong as the world’s equity funding leader, will be able to support mainland enterprises in raising capitals for infrastructure spending and leading renminbi (RMB) internationalization.

Hong Kong has become the most comprehensive and competitive platform for offshore RMB business. As of 2014, offshore RMB deposits has exceeded 2 trillion yuan, of which over 1.16 trillion yuan are deposited in Hong Kong, and the cross-border RMB payment between China and Hong Kong accounted for 52.7% across all offshore regions.

Hong Kong also plays an important role in information sharing and helps Mainland enterprises to acquaint itself with the international market rules in the “going out” process.

3. Skilled Staffs

Hong Kong has been actively developing its international business and has gained valuable operational experience over the years.

There is a large pool of local sophisticated and experienced professions who understand the Western or Chinese business culture difference will be able to assist Chinese enterprises in the endeavors in the “go out” process. Hong Kong can serve as a liaison platform in satisfying the demand derives from the Initiative.

Conclusion

In recent years, the Chinese government encourages the local enterprises to “go out to invest”, and the demand for outbound expansion in Mainland is surging. In the process of going out, Hong Kong has naturally become an ideal platform due to its developed financial system, no money flow restriction and excellent professional services.

If you are interested to learn more on this tpoic and benefits of establishing a company in different jurisdiction, please feel free to contact us.

New Third Board is a national “over-the-counter” market regulated by the China Securities Regulatory Commission (CSRC) which allows the national small and medium-sized enterprises (SMEs) to raise capital via share transfers to investors. There are generally three mechanisms for off-market transfer, namely market making, by agreement and bidding. This platform provides an alternative financing channel to small enterprises especially those who are still awaiting to meet the initial public offering (IPO) requirement.

The entry requirement on the New Third Board is very relax and the following are the main conditions:

- The company has been lawfully established and existence for at least two years;

- The company must have well defined business direction and the ability to continue as an ongoing business;

- The company must have a sounded corporate governance mechanism and carry out its operations in a lawful and regulated manner.

Development of New Third Board market

Since 2012, companies listed on New Third Board has grown tremendously and it has become increasingly popular for SMEs to raise funds through this platform. It has been seen as an easier financing method with low costs for start-up firms or companies with liquidity issue who are unqualified to be listed on major exchanges.

Challenges on New Third Board market

The New Third Board has attracted tremendous interest of small-cap companies such as start-ups because of its less stringent qualification requirements and lower costs to get traded on this platform. In addition, CSRC has previously suspended all initial public offerings in the two main markets and forcing companies to raise capital on the third board which is not covered by the IPO ban.

It is not surprising to see that the current market making and mutual agreement mechanism adopted in the New Third Board market has contributed in enlarging the trading volume as it becomes easier to close a deal. As a less regulated market, the public investors are seeing more investment opportunities in these ‘concept’ stocks and the amount of speculative trading on New Third Board market has inevitably increased.

Volatility is also one of the problem facing by the third board stocks as there is no cap imposed on the daily trading limits and hence it is not unusual for some stocks to swing 300 to 400 per cent a day. The volatility has discouraged long term investors in the third board and potentially constrained the business development of the SMEs.

Fund raising alternatives

Until the third board will be able to maintain a fair and regulated market, the current share transfer mechanism might not be seen as an ideal way for Chinese SMEs to raise funds. Financing always plays a significant role in supporting small business development and it is crucial for enterprises to adopt a suitable solution according to its development plan

Below are three common financing tools available in the market for the enterprises to raise funds:

1. Foreign Loan with domestic security “Nei Bao Wai Dai” (内保外赁)

An onshore entity or individual providing security or guarantees to an offshore creditor to secure the obligations of an offshore principal debtor.

2. Finance lease

According to the specific requirements of the lessee for the lease object and the selection of the supplier, lessor finance the purchase of the lease object and lease to lessee, the lessee pay rent to the lessor by installments. The ownership of the lease object belongs to the lessor, the lessee only has the right to use the lease object.

3. Intellectual property mortgage financing

This is a financing activity in which the intellectual property rights holders obtain funds from banks or other financial institutions by taking their property rights in the intellectual property as subject matter of pledge. The property rights are subject to evaluation and pricing before their holders can get the funds and the rights holders are bound to repay the principal and interest of the funds on time.

Conclusion

Despite financing through New Third Board has been popular among Chinese enterprises, its loosen regulation and stock price volatility issue might not be a good way to support the new third board for start-ups. There are various financing methods which are more promising and stable, enterprises are encouraged to seek advice from professionals to assess your business situation on a case by case basis. Hong Kong, as the world’s equity funding leader, is the ideal gateway for Chinese enterprises who currently plan to “going out”.

If you would like to acquire more information about corporate financing, please contact us for advisory services.