Newsletter Q4 2014 – Company Highlight

– Event 1 –

As a young committee member of the Hong Kong Institute of Certified Public Accountants (HKICPA), our Director Ms. CY Chan assisted with an official four-day visit to Eastern China. It was our honor to be part of this meaningful event as it helped many young members of HKICPA to better understand the markets of Jiangsu Province and Shanghai.

Event Name: Young Members’ Group, HK Institute of Certified Public Accountants

– A visit to Eastern China

Location: Nanjing, Shanghai

Date: 25th – 28th October, 2014

To gain a better understanding of the Jiangsu Province’s economic development, we visited the United Front Work Department of the Provincial Party Committee. This government unit not only sets the strategy on creating a united front and implementing the Central Government’s policies. In addition, they are responsible for research on the financial status of the representatives of non-public economy and coordinate their relationship and thereby provide recommendations on policies. It was our honor to meet representatives from the United Front Work Department of the Provincial Party Committee for further discussion.

To explore the recent economic development of Shanghai, we continued our visit to the United Front Work Department of the Municipal Party Committee of Shanghai and then visited the Municipal Department of Finance and State Tax Bureau.

Each institute reported the city’s fiscal and tax status, and introduced the latest tax policies and its effects on foreign investors. Through this valuable visit, our firm has gained a good understanding about the latest tax system and the direction of Shanghai’s tax policy next few years.

Had a productive meeting with Shanghai’s outstanding young entrepreneurs is the highlight of this visit. The Shanghai’s Young Entrepreneurs Association is a non-profit, non-government organization. Its main committee members include: the VP of Boshiwa International Holding Limited, Mr. LV Yihao; the Director of Longyun Asset Management, Mr. SONG Jiebin; the General Manager of Jinlan Financial, Ms. LI Jielan; the Deputy General Manager of the Shanghai China Petroleum Enterprise Group, Ms. TAO Xin; and the Vice Secretary of Shanghai’s Young Entrepreneurs Association, Ms. ZHU Xinyu. During the meeting, we discussed the possibility and opportunities of having more Hongkong’s young talents to start their own business in Shanghai.

– Event 2 –

In order to maintain Hong Kong’s competitiveness, Prof. KC Chan, the Secretary for Financial Services and the Treasury, announced that Hong Kong will soon adopt the latest standard of international taxation transparency. Our director CY Chan attended an international conference organized by the Taxation Institute of Hong Kong in this November. Other attendees include representatives from the State Administration of Taxation, the Ministry of Finance, and the Inland Revenue Department. Professionals and officials discussed the current transparency of the tax system in Hong Kong and the effects on the financial structure brought by the Base Erosion and Profit Shifting (BEPS) project.

Event Name: CTA Conference — Tax transparency, are you ready?

Location: Hong Kong

Date: 28th November, 2014

The CTA Conference aims to provide a platform for exchanging the latest tax development and BEPS. The Guest of Honor, Mr John Tsang Chun-wah, GBM, JP, shared his views on the prospects of Hong Kong tax system and provided technical updates for corporations to prepare for potential challenges and uncertainties in the future. During the conference, guest speakers discussed the BEPS Action Plan and its implication to Hong Kong and Mainland China.

Our Director Ms. CY Chan had a productive dialogue with many accounting and taxation professionals at the forum. She shared her views on Hong Kong’s tax system and pointed out that the government will make major changes towards a more transparent tax system. Therefore, Hong Kong’s enterprises will need to get prepared for this upcoming adjustment in the next 5-10 years. For a deeper understanding of the effect of BEPS on the systems in Hong Kong and Mainland China, we will continue our discussion in “Market Flash”.

Market Flash

– Preparing for Tax Reform in 2015 –

For centuries, Double Taxation Agreement has been developed to eliminate double taxation on an individual or corporation in supporting the growth of the global economy. This development has ended up facilitating double non-taxation and led to a critical situation with increasing people avoiding tax in worldwide. “Times magazine” revealed that Google has shifted billions of revenues arising in the U.S. to shell companies established in five countries including Ireland and the Netherlands, in order to escape 35% U.S. tax obligation.

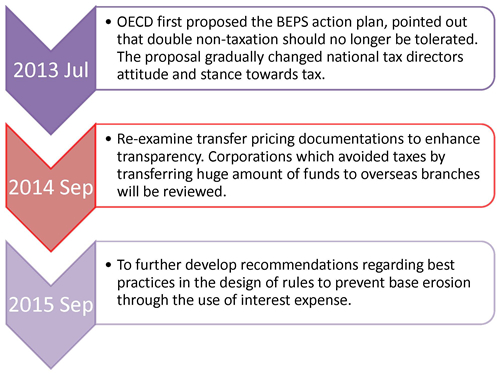

On July 2013, the Organization for Economic Co-operation and Development (OECD) released its Base Erosion & Profit Shifting (BEPS) Action Plan with the aim to tackle double non-taxation corporation, cross-border tax avoidance and evasion cases. The action plan places great effort in enhancing the coordination and collaboration among tax authority of different countries to combat the phenomenon of tax escape through the unjustifiable use of tax havens and to draw up transparent standards for tax authority to have an automatic tax information exchange among countries to prevent BEPS issues.

Below are the key dates and deliverables:

Needless to say, preventing tax treaty abuse has become increasingly important where numerous international government bodies are collaboratively working on new global standards to close the loopholes, even multinational companies such as Google cannot be escaped.

With the implementation of BEPS actions on the road, multinational companies should monitor these developments in order to effectively plan for their operation structure and adopt the most advantageous tax strategy so as to minimize the potential impact derive from these international tax reform.

In other words, to tackle these issues brought by the BEPS actions plan, companies need to understand the comparative advantage of each market location that could bring to their business and then further design a business structure that could fully utilize the unique benefit generates in the market. For instance, company establishing an operation in a developing country can enjoy the a production cost and focus the investment on their core management and support function in developed place, such as Hong Kong, which can provide various professional services with international standard. This all because Hong Kong is a place which enjoys sustainable financial system, with low corporate tax rate and reliable economical fundamentals, which can create a reliable environment to handle management and support services.

In short run, company can reasonably reduce the overall corporate tax liabilities by simply placing the core management function in Hong Kong. As a reference, the tax rate in Hong Kong is only 16.5%, significantly lower than 35% in U.S., 28% in U.K. and 27% in China. Most importantly, enterprises can easily find long term support for high quality professional services with international standard, such as financial, accounting, law and risk management in Hong Kong and is irreplaceable by other countries – Hong Kong as an international financial centre is widely recognize which makes Hong Kong to be the best place to invest.

To have a better illustration:

A Korean citizen who runs international business activities can (1) place the production line in a Low-Cost developing countries (e.g. China), whilst (2) establish a base office in a developed countries (e.g. Hong Kong) to utilize the professional resources in the market to support for their core management function. Under such circumstances, despite the Korean citizen is liable for both PRC tax and Hong Kong tax, it will still put the business in a more advantageous position with this arrangement:

- The overall tax payment is still lower than just paying all in China.

- Greatly reduces the opearting cost by having a production base in China instead of Korea.

- Enjoy the benefit of using the professional support services in Hong Kong.

- Tax authorities will not actively issue review documents to him which saves lots of administrative work.