In February 2017, the Financial Secretary has announced 2017/18 Budget, outlining the plans for the economy and proposals for changes to taxation. The major proposed tax concessions and measures including:

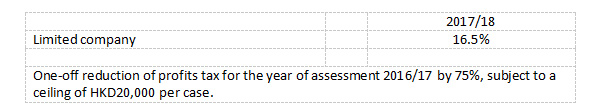

For Profits Tax

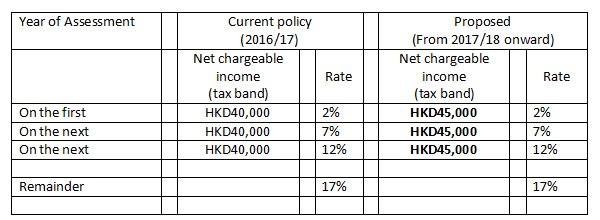

For Salaries/ Individuals Tax

(i) Increasing the width of marginal tax bands

(ii) One-off reduction of salaries tax for the year of assessment 2016/17 by 75%, subject to a ceiling of HKD20,000 per case

(iii) Increasing allowances

- Disable dependent allowance increase from HKD66,000 to HKD75,000

- Dependent brother or sister allowance from HKD33,000 to HKD37,500

(iv) Increase expenses deduction ceiling

- Self-education expenses deduction increase from HKD80,000 to HKD100,000

For Small and Medium Enterprises (“SME”)

(i) Dedicated Fund on Branding, Upgrading and Domestic Sales

To assist Hong Kong Company to expand their business in Mainland China, there is a proposal to extend the application period for the Dedicated Fund on Branding, Upgrading and Domestic Sales for five years to June 2022

(ii) Concessionary under SME Financing Guarantee Scheme

Extend the application period for the ‘Special Concessionary Measures’ under the SME Financing Guarantee Scheme to 28 February 2018

(iii) Strengthen the underwriting capacity under the Hong Kong Export Credit Insurance Corporation (ECIC)

Raise the cap on the contingent liability of the Hong Kong Export Credit Insurance Corporation underinsurance contracts from HKD 40 billion to HKD 55 billion