Background of Tax Reforms

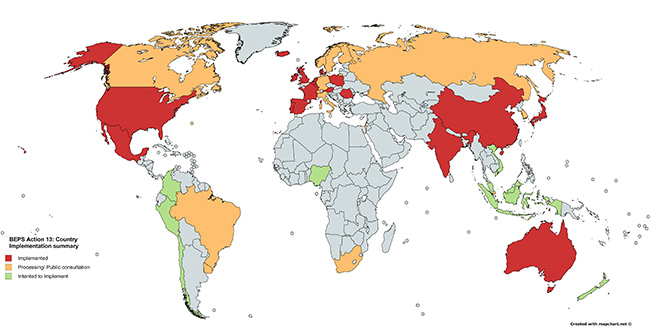

Since G20 leaders decided to update international tax rules, countries started to implement Base Erosion and Profit Shifting (BEPS) project which released by the Organisation for Economic Co-operation and Development’s (OECD). The tax reforms put an end to any tax advantage companies receive by shifting their profits into tax havens and it close the opportunities that companies take benefits from agressive tax planning. Meanwhile, the BEPS reforms is likely to increase the tax burdens and uncertainty of the company’s tax exposure, companies that are prompt in preparing and make adjustments before the tax changes would help to shape a competitive advantage over competitors.

What is a BEPS project?

According to the interpretation of OECD, “BEPS project is a tax aviodance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. Under the inclusive framework, over 100 countries and jurisdictions are collaborating to implement the BEPS measures and tackle BEPS.”

How does it change the tax exposure and potential tax costs of a company?

Fact findings in 2016/ Impacts of BEPS

Evidence showed that there is a growing list of tax investigations and disputes between governmental authorities and MNEs over their offshore funds.

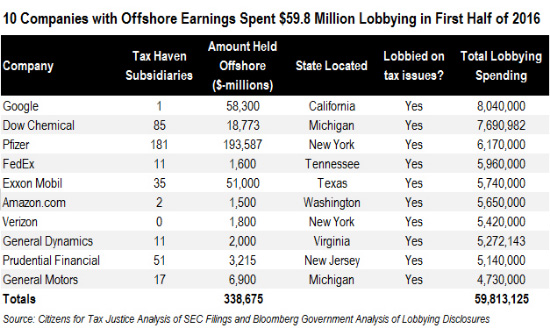

A report of Aaron Menderlson, ITEP interim published that:

Prominent Cases in 2016:

- EU investigators have examined how paid a tax rate of less than 1% on their European sales in last some years

- reached an agreement with UK government to pay additional £130 million in corporate tax and interest

- The group has been accused of evading taxes for at least €1 billion in Europe

Who will be the European Commission’s next target?

There are 15 Actions in the BEPS Project (see note 1), including digital economy, interest deductions, transfer pricing and disclosure of aggressive tax. Each jurisdiction is considering to implement the recommendations laid out in OECD’s final reports on BEPS action plan.

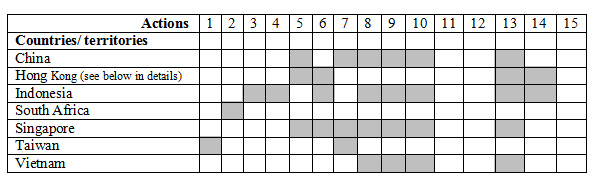

Country Focus on BEPS Actions

Many individual countries begin to implement the OECD’s recommendation pursuant to their own interpretations of various action items. Below provides a snapshot of focus taken by each individual countries/ territories:

Note 1:

BEPS Profit- 15 Actions released by OECD

The principle of each actions:

Action 1: Address the tax challenges of the digital economy;

Action 2: Neutralise the effects of hybrid mismatch arrangements

Action 3: Strengthen controlled foreign companies rules;

Action 4: Limit base erosion via interest deductions and other financial payments

Action 5: Counter harmful tax practices more effectively, taking into account transparency & substance

Action 6: Prevent treaty abuse;

Action 7: Prevent artificial avoidance of Permanent establishment (PE) status

Action 8, 9, 10: Assure that transfer pricing outcomes are in line with value creation;

Action 11: Establish methodologies to collect and analyze data on BEPS;

Action 12: Require taxpayers to disclose aggressive tax-planning arrangements;

Action 13: Re-examine transfer pricing documentation and institute Country by Country Reporting (“CbC Reporting”)

Action 14: Make dispute resolution mechanisms more effective; Action 15: Develop a multilateral instrument

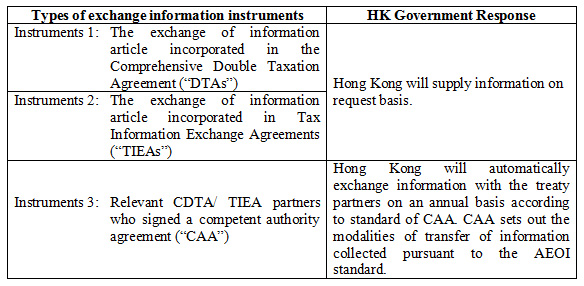

Hong Kong Actions in response to BEPS- Action 13

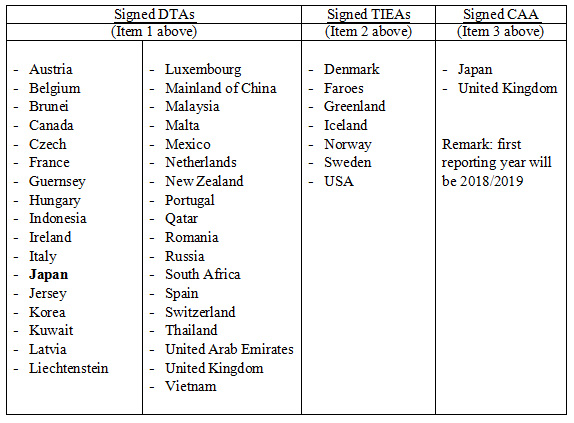

Under the current mechanism, HK has 3 types of exchange information instruments to supply information to treaty partners:

Hong Kong has signed with below countries/ territories:

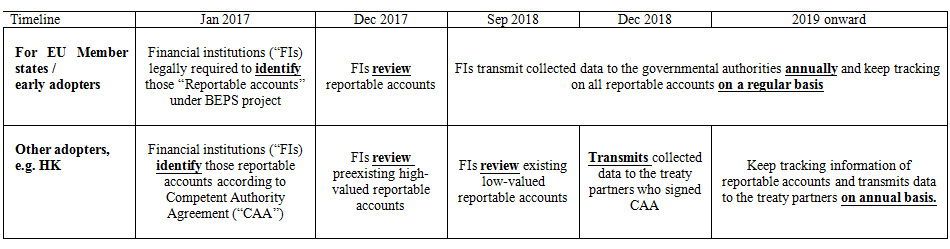

Timetable dedicated by EU/ non-EU members

Information to be reported:

- Interests

- Dividends

- Account balance/ Account values

- Sales proceeds from financial assets, etc…

Case illustration

“BEPS [reform] significantly increases the likelihood that a company’s existing business model that was formerly not locally taxable becomes a taxable presence.” says Paul Griffiths of the EY Asia-Pacific Tax Center.

It was believed that the BEPS project is a business transformation issue rather than simply a global tax reform. How does it change the business practices? How does it change the tax exposure and potential tax costs of a company?

The examples below demonstrate the tax impact:

Tax exposure of ABC Trading Co. (“ABC”)

IN THE PAST:

- ABC was not liable to tax in Country A because there is no office, no personnel and no activity presence in Country A.

- In addition, ABC would not be locally taxable in UK/ PRC as there was no taxable presence.

NOW, under BEPS project:

- ABC is still not liable to tax in Country A because there are no office, no personnel and no activity presence in Country A. However, Country A will collect ABC’s financial information and subsequently provide to UK and PRC according to BEPS action 13- CbC Reporting.

- OECD redefines the meaning of tax presence. With activities which related to planning, procurement and service spectrum, ABC is now considered to have Permanent Establishment (“PE”) in UK and PRC and therefore having a taxable presence.

- With the reason in point 2, UK and PRC will assess the financial information collected from Country A and to determine ABC as taxable in UK and PRC.

Finding the way forward

It is a time to rethink your business or operating model to avoid inefficiencies and extra costs, and to allow your company to better navigate a new environment.

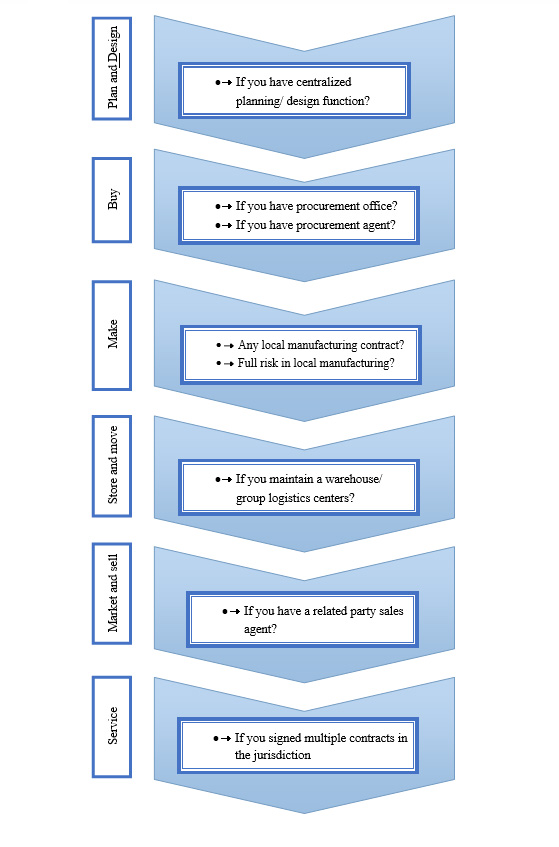

Take a look at the entire value chain of your business model associated with BEPS actions, the presence of any below elements can give rise to a taxable presence even though there is no physical office/ company established in a country:

Conclusion

To gain a comparative advantage or to avoid losing your competitiveness in this new world, don’t wait and see. You should have a better management of your tax position in a proactive way, identify potential risk and uncertainties that your current business model is facing, manage tax exposure and develop the most tax-efficient structure for your business.

If you would like to learn more about the impact of BEPS project/ CRS/ CbC reporting/ AEOI, please contact us for advisory service.