– Event 1 –

Event Name: Investigating the Free Trade Zone in Nansha

Location: Nansha, China

Date: 17th April 2017

We are delighted to be a participant of the tour to the Free Trade Zone in Nansha, which organized by the Association of Sino Enterprises Promotion (ASEP), for an inspection and discussion.

The overall development of the Nansha Free Trade Zone, various business innovation services, economic and trade preferential policies and measures were well discussed. The representatives of the Nansha Free Trade Zone Administration have exchanged the latest entrepreneur and business environment with us. Operations that have accessed to the district were interviewed. Last but not least, the representatives of The Chinese Institute of Certified Public Accountants and the government had shared their views on recent development during a precious meal time together.

We would like to express our gratitude to ASEP for holding a fruitful trip for us to obtain a deeper understanding on the recent development of the Nansha Free Trade Zone.

– Event 2 –

Event Name: Summit on the New Directions for Taxation

Location: Central Government Offices, Hong Kong

Date: 23th October 2017

Our managing director Ms. CY Chan was invited to attend the Summit on the New Directions for Taxation (“the Summit”) by the Government of the Hong Kong Special Administrative Region.

The Summit is one of the key initiatives of the Current-term Government in seeking views on forward-looking tax policies and measures. Two main topics were discussed: (1) Global Trends for Tax Policy and (2) Tax Initiatives for Enhancing Economic Development. The Financial Secretary, Mr Paul CHAN Mo-po, delivered a keynote speech on the global trends for tax policy; followed by the keynote speech from Director of Center for Tax Policy and Administration, Mr Pascal SAINT-AMANS and Professor Lawrence J. LAU. Discussion sessions were arranged for us to share our views on tax initiatives for fostering economic development. The two Panel Discussions were: (1) Reinforcing Pillar Industries and (2) Towards a Diversified Economy.

If you are interested to have a deeper understanding about the topic, please feel free to contact us.

– Event 3 –

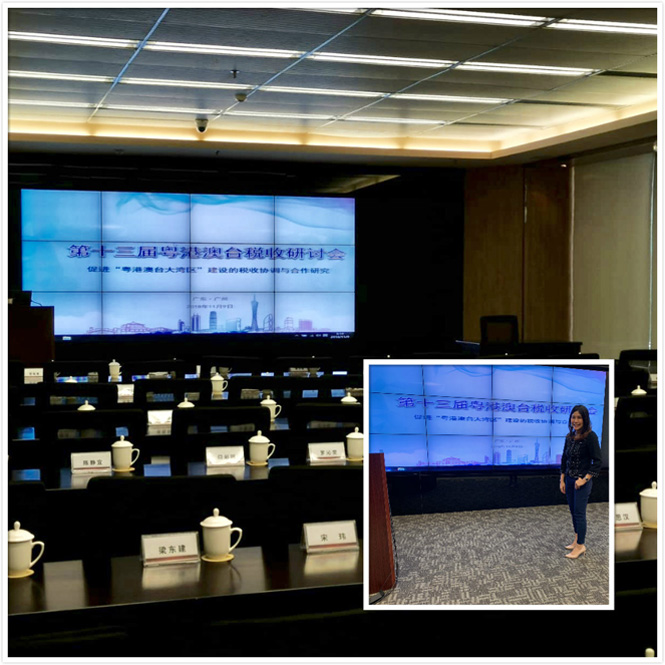

Event Name: Meeting of Guangdong, Hong Kong, Macau and Taiwan Tax Conference

Location: Guangzhou, China

Date: 9th November 2018

Our managing director Ms. CY Chan was invited to attend the 13th Annual General Meeting of Guangdong, Hong Kong, Macau and Taiwan Tax Conference, which organized by The Chinese Tax Institute, to strengthen the academic exchange about tax among these 4 jurisdictions.

The agenda of this Conference was “Research on Tax Coordination and Cooperation in Promoting the Construction of Guangdong-Hong Kong-Macao Greater Bay Area”. Ms. Wong Wai Pan, The President of Board of Directors of our Association, headed five members to participate in this Conference. In correspond to the topic, Ms. Ho Choi San, Técnico Superior Assessor Principal from Macau Financial Services Bureau were invited to discuss the view on current Macau tax system and policy, Bilateral Tax Agreement, Integration Opportunities and Challenges of The Greater Bay Area, and Cross Border Coordination and Cooperation between Tax Authorities.

If you are interested into these topics, please feel free to contact us for further information.

– Event 4 –

Event Name: CTA Conference 2018: Fall Behind or Go Beyond in Achieving BEPS Compliance Excellence and Preparing for Greater Bay Area Opportunities?

Location: Hong Kong Convention and Exhibition Centre, Hong Kong

Date: 23th November 2018

Our managing director Ms. CY Chan was again being invited to attend the Tax Conference organized by The Taxation Institute of Hong Kong(TIHK).

This year, the Conference continues to aim at offering a platform for exchanging the latest tax development and helping participants acquire industry insights to prepare for unexpected challenges in the future. The Conference also serves as a great platform for sharing insights on how to leverage on the numerous opportunities from the Greater Bay Area. Prominent speakers from overseas, Mainland China’s and Hong Kong’s tax authorities, experienced practitioners from leading Professional firms as well as business owners and investors had shared their views on the above theme.